⚠️ AS OF JULY 1ST ATO INTEREST IS NO LONGER TAX DEDUCTIBLE ⚠️

⚠️ AS OF JULY 1ST ATO INTEREST

IS NO LONGER TAX DEDUCTIBLE ⚠️

See How Aussie Business Owners Are Refinancing ATO Debt, Saving Thousands & Freeing Up Cash Flow - Without Bank Rejection, or Admin Stress

Book Your Free 15-Minute ‘ATO Debt Escape Plan’ Today and Finally Understand What Options Are Actually Available to You

Completely free to explore.

No strings attached.

Every Day You Wait, You’re Bleeding Profits and Losing Deals

You’ve found the perfect site.

The numbers stack up.

But then—the funding stalls.

Banks drown you in red tape, private lenders slap on sky-high interest rates, and your project? Dead in the water.

Each delay sends costs spiralling—holding expenses, rising interest rates, and supplier prices creeping up by the day.

The longer you wait, the thinner your margins get, turning a once-profitable project into a financial headache.

Deadlines loom, budgets blow out, and suddenly you're scrambling to plug gaps just to keep things afloat.

While you’re battling delays, your competitors are closing deals, breaking ground, and cashing in.

The sites you scouted? Gone.

The profits you planned for? In someone else’s pocket.

Months of planning, negotiations, and site analysis? Wasted, all because the funding didn’t come through.

But it doesn’t have to be this way.

Hi, I’m Michael, Director at Balcombe Financial.

We help property developers secure the funding they need to acquire, build, and complete high-return developments—without the usual financial roadblocks.

Whether you’re working on a small subdivision, a large-scale apartment complex, or a commercial development, we tailor solutions that move your projects forward fast and with maximum flexibility.

With access to over 40+ bank, non-bank, and private lending solutions, we unlock flexible terms, maximise your loan amounts, and keep your projects moving from acquisition to completion.

“Michael found me a loan that others said wasn't possible”

- John Zambelis, Victoria

“Michael’s professional services were key in securing the finance on our commercial development in a tight timeframe”

- Casey Landman, Victoria

No more missed deadlines. No more compromises.

Just streamlined, stress-free financing that lets you scale your portfolio, maximise your profits, and build long-term wealth.

Ready to secure the capital you need—fast and stress-free?

Apply for your free 'Get Funded' Consultation with Victoria’s top property development finance experts.

We’ll never leave it up to algorithms or call centre staff to future growth of your projects.

In this complimentary 20-minute session, we’ll help you:

1

GET A FINANCING STRUCTURE BUILT FOR YOUR PROJECT:

Discover the exact funding solution for your development goals—no more ‘one-size fits all’ loans that don’t fit your needs.

2

SECURE FAST APPROVALS WITHOUT THE USUAL ROADBLOCKS: We’ll map out how to cut through lender red tape and get your project moving—before delays eat into your profits.

3

FUND YOUR PROJECT WITH LESS OF YOUR MONEY: We’ll show you how to secure financing with minimal personal capital and more lender flexibility than you thought possible.

4

WALK AWAY WITH A CLEAR, ACTIONABLE FUNDING STRATEGY: Get a clear, actionable financing strategy tailored to your development—no fluff, no wasted time, just the exact next steps to get funded fast.

Spots are limited, and projects are moving fast.

Don’t let another opportunity slip through your fingers— apply for your free ‘Get Funded’ Strategy Session today and secure the financing you need before it’s too late.

To your success,

Recent Client Wins Helping Aussie Business Owners Just Like You

From $120K ATO Nightmare to Financial Breathing Room

A Sydney builder racked up $120,000 in ATO debt after project delays and inconsistent cash flow. With outdated tax returns and poor credit, banks said no. We refinanced using equity in his home, clearing the debt, unlocking working capital, and giving him much needed breathing room.

Refinanced $64K ATO Debt and Avoided Legal Action

After a tough year, a truckie from Victoria faced $64K in tax debt. The ATO was circling, and he feared losing everything… including his trucks. We reviewed his asset position and refinanced his existing truck loans, rolling the ATO debt into a lower cost structure, protecting his assets and keeping his business alive.

$37K Tax Burden Refinanced into One Simple Payment

During COVID, a small family-run retail store in Sydney fell behind on tax and owed $37,202. Cash flow was tight and repayments unmanageable. We arranged a business loan refinance through a specialist lender that paid out the debt and replaced it with one clear, predictable repayment… giving them back control and peace of mind.

Restructured $330K ATO Debt and Saved Their Business

A hospitality group operating several Sydney venues had fallen $330K behind with the ATO due to deferred PAYG and Super during the pandemic. Legal threats were looming. We refinanced their commercial property, cleared the full debt, and helped them requalify for funding. They kept their staff, stabilised operations, and are now rebuilding stronger.

Completely free to explore.

No strings attached.

If You’ve Got ATO Debt and a Business to Protect, Read This Before You Do Anything Else

Dear hard working business owner,

You’ve done everything right.

You built something from the ground up. You put in the hours. You backed yourself when no one else would.

But now the ATO is hanging over your head like a dark cloud…

And no matter how hard you work, it feels like you’re treading water.

You’ve probably tried to set up a payment plan. Maybe you asked your bank for help.

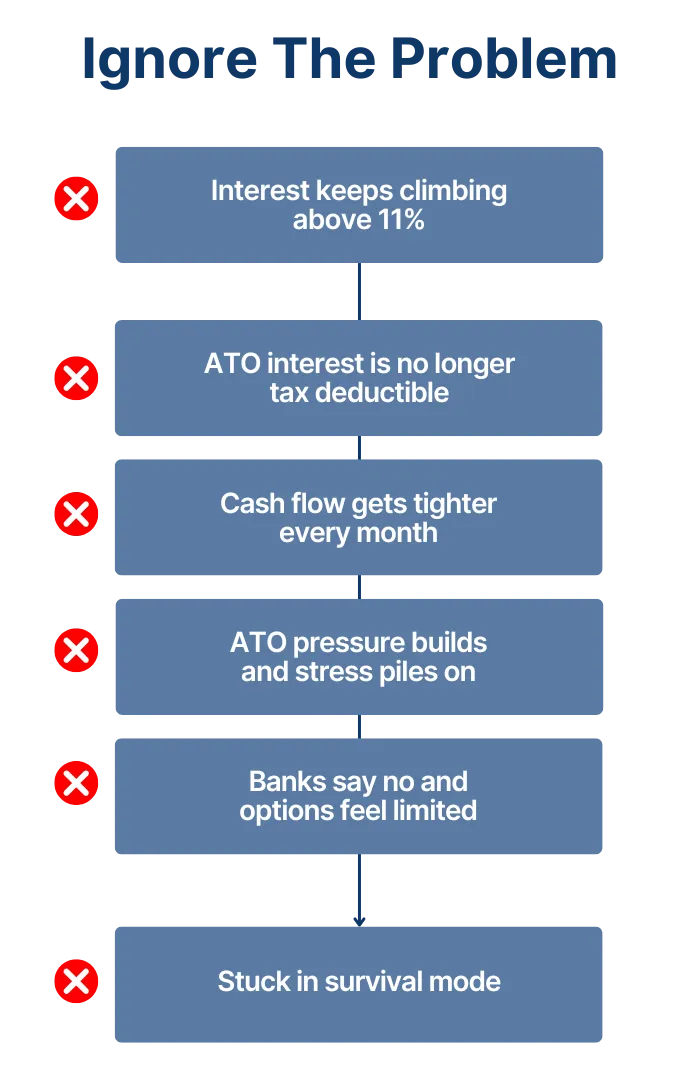

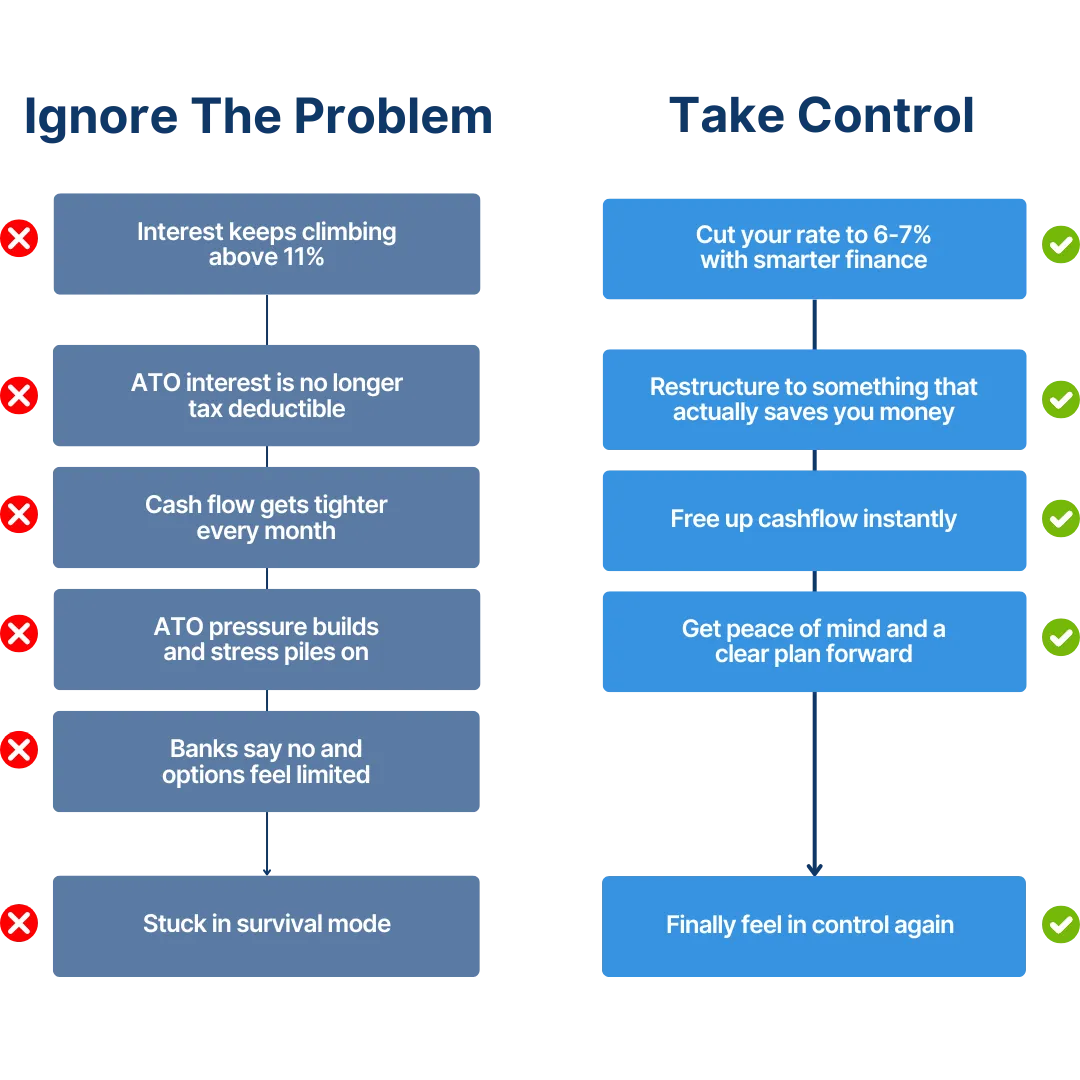

But the interest keeps climbing (over 11%), and after July 1st... you can’t even claim it as a deduction anymore.

You’re stuck in survival mode, choking on repayments, falling behind, and hoping things “just sort themselves out.”

Spoiler alert… they won’t.

This is how good businesses go under.

Quietly. From cash flow pressure that never lets up.

But this is also the moment you turn it around.

I’m Sanjay, founder of Verma Finance.

We help self-employed Aussies just like you restructure ATO debt into smarter, lower-cost loans—so they can finally breathe again, grow, and move forward.

I’m Sanjay, Founder of Verma Finance.

We help self-employed Aussies just like you restructure ATO debt into smarter, lower-cost loans - so they can finally breathe again, grow, and move forward.

We’ve been doing this for 25+ years and have ONLY 5-star reviews.

We work with 60+ lenders who actually get your situation.

And we've helped clients transform crushing ATO debt of $64k, $120k, even $330k into manageable, lower-cost loan structures - giving them immediate breathing room, reduced interest rates, and freedom from ATO pressure.

That’s why I’d like to personally invite you for free 15-minute "ATO Debt Escape Plan".

On this call, you’ll get:

1

Which finance options are actually available to people in your situation

2

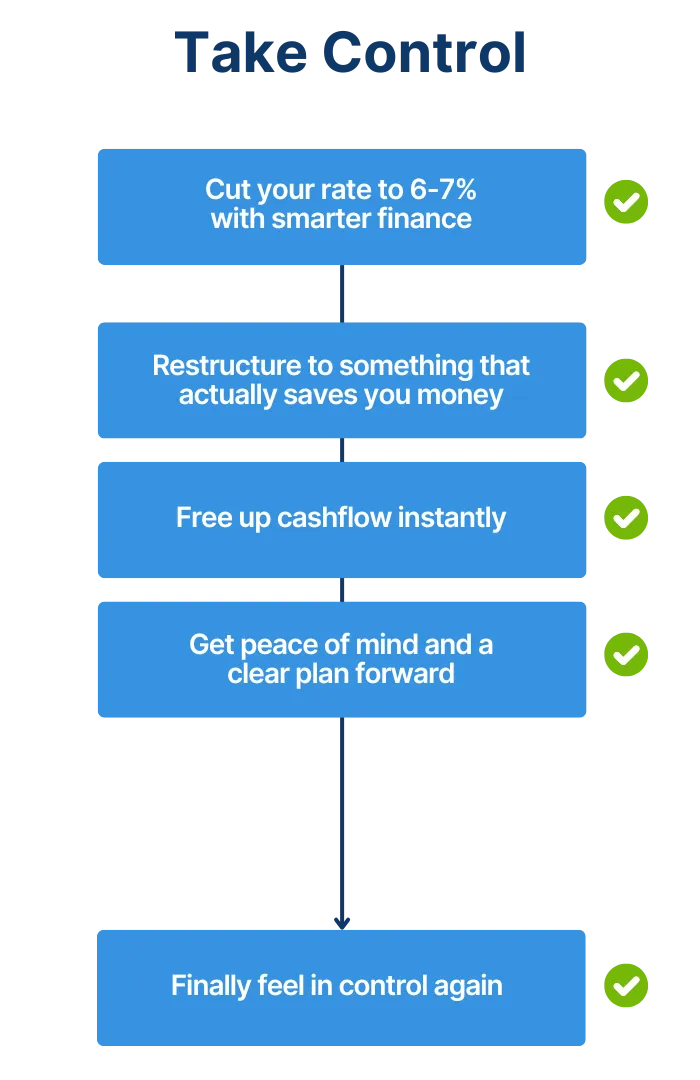

How to reduce your 11% ATO debt interest rate to 6-7% and free up cash flow quickly.

3

What you can realistically do today - even if your credit isn’t perfect

4

Clarity and peace of mind, in one no-pressure strategy call

Stop struggling in silence. Let’s get you a way out.

To your success,

Completely free to explore.

No strings attached.

Unlock Cashflow & Breathing Room in 5 Simple Steps

The 'ATO Relief Blueprint' is our proven process designed specifically for self-employed Aussies drowning in tax debt.

We'll have you out of panic mode and back in control in a matter of weeks.

Strategy Session:

We start with a quick, pressure-free chat to understand your ATO debt, cash flow situation, credit history, and future goals. This helps us map out exactly what’s possible for your unique circumstances.

Lender & Scenario Research:

You won’t get generic advice. We search across 60+ non-bank and private lenders to find tailored finance options that actually work—even if you’ve been declined before.

Strategy Session:

We start with a quick, obligation-free chat to understand your ATO debt, cash flow situation, credit history, and future goals. This helps us map out exactly what’s possible for your unique circumstances.

Lender & Scenario Research:

You won’t get generic advice. We search across 60+ non-bank and private lenders to find tailored finance options that actually work—even if you’ve been declined before.

Custom Finance Report:

We break down your best options in a clear, easy-to-read report. You’ll see rates, repayments, total savings, and exactly what your next steps could look like... without any pressure to commit.

Custom Finance Report:

We break down your best options in a clear, easy-to-read report. You’ll see rates, repayments, total savings, and exactly what your next steps could look like—without any pressure to commit.

We Handle Everything:

If you’re ready to move forward, we take the wheel. From paperwork to lender negotiations, waiting on hold to banks, we manage the full process so you can stay focused on running your business.

Debt Refinanced. Cash Flow Back. Mind Clear:

If you’re ready to move forward, we take the wheel. From paperwork to lender negotiations, we manage the full process so you can stay focused on running your business.

We Handle Everything:

If you’re ready to move forward, we take the wheel. From paperwork to lender negotiations, we manage the full process so you can stay focused on running your business.

Debt Refinanced. Cash Flow Back. Mind Clear:

Your ATO debt is gone. Your repayments are lower. Your stress is off your shoulders. You walk away with more breathing room and a clean financial foundation, ready to move forward with confidence.

Completely free to explore.

No strings attached.

Don’t Just Take Our Word for It—See What Our Clients Say

"I was struggling with multiple debts and didn’t know where to turn. Sanjay helped me consolidate everything into one manageable loan with better terms. Their experience and connections with lenders made all the difference. Highly recommend for anyone overwhelmed by finance issues."

- Sarah L.

"I had an excellent experience with Verma Finance Group! Their team was incredibly professional, knowledgeable, and efficient. The entire process was smooth, transparent, and much faster than I expected. They took the time to understand my business needs and provided a tailored solution that worked perfectly for me."

- Jit P.

"Knowledgeable professionals with years of experience in the finance field. Very helpful with good knowledge of various products offered by different banks and always think about customers’ benefit first."

- Munish G.

"Verma Finance made the entire refinancing process so easy. They handled all the paperwork and negotiations, which saved me a lot of time and stress. Their team is knowledgeable and really cares about helping small business owners get back on track financially."

- Michael J.

"Incredibly helpful, friendly, understanding and efficient. They took the time to understand what I needed without being pushy and have given me loads of advice along the way. I couldn’t recommend VFG highly enough. Outstanding people, outstanding service!"

- Greg M.

"Professional, efficient, and supportive. Sanjay & Suveer at Verma Finance worked with me to find a solution tailored to my business needs. They explained everything clearly and took care of all the complicated stuff. I now have peace of mind and better cash flow thanks to their help."

- David P.

"The team at VFG is fantastic. They really understand the challenges of running a small business and helped me refinance my loans smoothly. Their hassle free process meant I could focus on my business while they handled the finance side. I’m very grateful."

- Emma K.

"After being rejected by my bank, I wasn’t sure what my other options were. Sanjay found lenders willing to work with me and structured a loan that suited my situation perfectly. Their expertise and persistence saved my business."

- James R.

Completely free to explore.

No strings attached.

⚠️ AS OF JULY 1ST ATO INTEREST IS

NO LONGER TAX DEDUCTIBLE ⚠️

⚠️ AS OF JULY 1ST ATO INTEREST IS NO LONGER TAX DEDUCTIBLE ⚠️

Book Your Free 15 Minute ‘ATO Debt Escape Plan’ and See Exactly What Your Options Are—Before Things Get Worse

1

Which finance options are actually available to people in your situation.

2

How to reduce your 11% ATO debt interest rate to 6-7% and free up cash flow quickly.

3

What you can realistically do today - even if your credit isn’t perfect.

4

Clarity and peace of mind, in one no-pressure strategy call

Completely free to explore.

No strings attached.

Why Smart Business Owners Choose Verma Finance

We Handle Everything. You’ve Got Enough on Your Plate.

Forget chasing lenders, filling out paperwork, waiting on hold to the banks & explaining yourself ten times over. We take care of everything behind the scenes… so you can get back to running your business, not stressing over finance admin.

We Handle Everything. You’ve Got Enough on Your Plate.

Forget chasing lenders, filling out paperwork, waiting on hold to the banks & explaining yourself ten times over. We take care of everything behind the scenes… so you can get back to running your business, not stressing over finance admin.

You’re an Experienced Developer Needing More Flexible Funding

Banks slow you down with pre-sale requirements and rigid terms. We connect you with private lenders, mezzanine finance, and high-LVR solutions so you can fund more projects and scale faster.

25+ Years of Finance Experience Navigating Tough Situations

We’ve seen it all—bad credit, no returns, declined by banks. And we know exactly how to get deals approved when the odds are stacked against you.

Access to 60+ Lenders and 1,000+ Loan Options

Most brokers have a tiny toolbox. We’ve got the whole shed. With access to over 1,000 loan products from 60+ non-bank and private lenders, we can structure the perfect loan solution for your unique situation.

Over 2 Decades in the Game. Nothing But 5-Star Reviews.

We’ve helped dozens of self-employed Australians get out from under crippling tax debt and back in control. With 20+ 5-star reviews and powerful case studies, our results speak louder than promises.

Our Help Is Free.

You Don’t Pay a Cent.

There’s no cost for our service. We don’t charge you a cent. We get paid a commission from the lender you decide to go with, for bringing them your business.

You’re a High-Level Developer Needing Strategic Funding for Large-Scale Projects

Managing multiple developments requires structured funding, not rigid bank loans. We secure private capital, JV finance, and flexible funding solutions tailored to your portfolio and growth strategy.

You’re a High-Level Developer Needing Strategic Funding for Large-Scale Projects

Managing multiple developments requires structured funding, not rigid bank loans. We secure private capital, JV finance, and flexible funding solutions tailored to your portfolio and growth strategy.

You’re a High-Level Developer Needing Strategic Funding for Large-Scale Projects

Managing multiple developments requires structured funding, not rigid bank loans. We secure private capital, JV finance, and flexible funding solutions tailored to your portfolio and growth strategy.

You’re a High-Level Developer Needing Strategic Funding for Large-Scale Projects

Managing multiple developments requires structured funding, not rigid bank loans. We secure private capital, JV finance, and flexible funding solutions tailored to your portfolio and growth strategy.

Completely free to explore.

No strings attached.

Completely free to explore.

No strings attached.

How Smart Developers

Get Funded

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Hidden Cost or Downsides of Competitors]

[Customer Support/Service]

B

Comparison #1

Comparison #1

100% Free, No-Obligations

⚠️ AS OF JULY 1ST ATO INTEREST IS NO LONGER TAX DEDUCTIBLE ⚠️

⚠️ AS OF JULY 1ST ATO INTEREST IS

NO LONGER TAX DEDUCTIBLE ⚠️

Book Your Free 15 Minute ‘ATO Debt Escape Plan’ and See Exactly What Your Options Are—Before Things Get Worse

Completely free to explore.

No strings attached.

Got Questions?

We’ve Got the Answers

What if my credit’s not great? Will anyone still help me?

Absolutely. We work with over 60 non-bank and private lenders who specialise in helping self-employed Aussies with imperfect credit. Banks might shut the door, but we know which lenders actually listen and approve. Bad credit isn’t the end.

Will this hurt my relationship with the ATO?

Nope. In fact, it does the opposite. By paying out or refinancing your ATO debt, you reduce the risk of legal action, penalties, and account freezes. The ATO just wants to get paid. You’re giving them what they want, and protecting your business in the process.

Is this legal? I thought banks didn’t allow tax debt refinancing.

It’s 100% legal—and smart. Major banks don’t like ATO debt, but non-bank lenders do things differently. We structure everything above board, through licensed lenders, with clear terms.

How long does the process take?

We move fast. Most clients get approved in a few short weeks. Once we’ve had the strategy call and collected what we need, we handle everything behind the scenes so you can keep running your business.

How much does this cost me?

Nothing. Zero. Zip. We’re paid by the lender you choose, so you don’t pay us a cent out of pocket. That means you get expert advice, a tailored solution, and end-to-end support for free.

What if I’ve already been declined by the bank?

You’re in the right place. Most of our clients come to us after banks said no. We’re not here to squeeze you into a rigid box—we find a lender and structure that fits your reality. Declined doesn’t mean done. It just means you need a better approach.

Our Service Will Help Decrease Burning Problem By Quantifiable Measure Or Penalty

We’re so confident in our ability to [Achieve Outcome] that we’re taking all the risk off your shoulders.

If we don’t [Specific Result Guarantee], you won’t pay a cent. No fine print, no hidden conditions – just a rock-solid guarantee to prove how committed we are to your success.

Because at [Your Business Name], we don’t just promise results. We guarantee them. If we don’t deliver, you don’t pay. It’s that simple.

100% Free, No-Obligations

Still Not Sure About Something?

Your 1st Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 2nd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 3rd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 4th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 5th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

100% Free, No-Obligations

Spots Are Filling Fast...

Claim Your Free Offer Name Today and Benefit

100% Free, No-Obligations

©2025 Verma Finance Group. All rights reserved.

Verma Finance Group Credit Representatives are authorised under Australian Credit Licence Number: 384704

Credit Representative number: 567006

Your full financial situation and requirements need to be considered prior to any offer and acceptance of a loan product.

1300 902 354 | [email protected]

Privacy Policy | Disclaimer